Disadvantages Of Indexed Universal Life Insurance

Indexed Universal Life IUL policies can help you build wealth and leave death benefits for your family members. A policy with a 0 or even a 2 minimum earnings rate with 25 costs can and often do lose money.

:max_bytes(150000):strip_icc()/GettyImages-1005014082-9bc5937167a54ad0b546762d6de89ace.jpg)

Pros Cons Of Indexed Universal Life Insurance

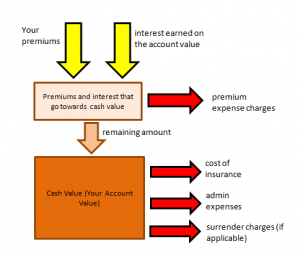

The way in which cash value crediting takes place can involve some moving parts So before making an IUL policy purchase it is important.

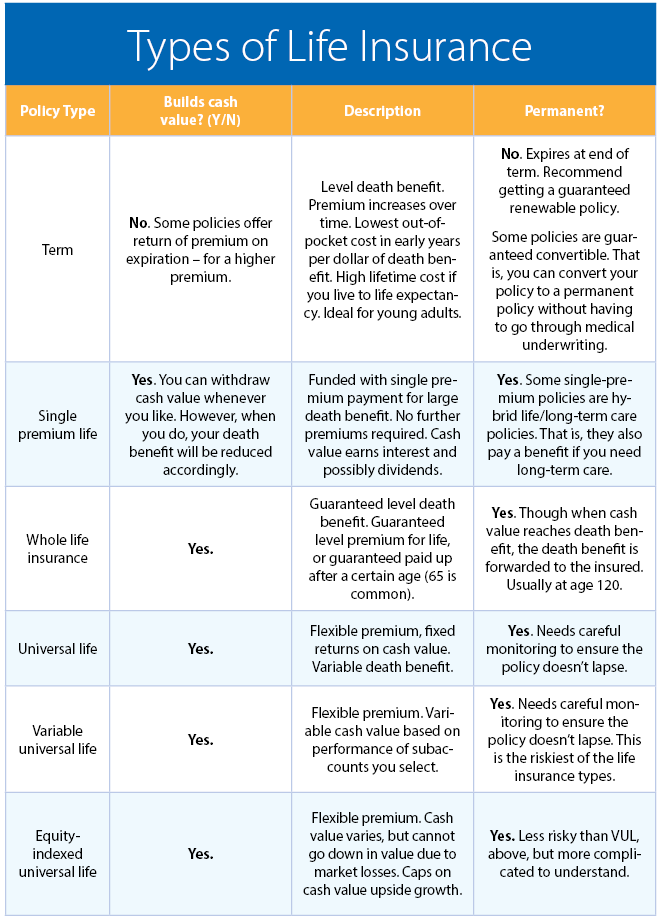

Disadvantages of indexed universal life insurance. Indexed Universal Life Insurance IUL is getting a lot of interest among those looking for small investment stocks with their life insurance protection these days. Indexed universal policies also include several fees that may increase over time. While indexed universal life trends cheaper than some other types of life insurance such as whole life insurance it is more expensive than term life coverage.

You no longer earn a rate of return on money borrowed from your policy cash value. Other downsides to indexed universal life insurance policies are. In 2014 the State of New Yorks insurance regulator probed 134 insurers on how they market such policies out of concern that they were exaggerating the potential gains to.

Policyowners of index universal life bear virtually all the disadvantages they would bear if they owned regular universal life. Even with all of the benefits that are provided with Indexed Universal Life there are some factors to consider before moving forward with the purchase of an IUL policy. Talk with a qualified life insurance agent to get more information.

The risks you assume when owning Indexed Universal Life Insurance are. The Disadvantages of Indexed Universal Life Insurance. A guaranteed minimum interest crediting rate.

In terms of disadvantages of indexed universal life insurance policies critics have pointed to the fact that as a permanent life insurance policy they come with high fees such as administrative and sales fees. This type of life insurance offers permanent coverage as long as premiums are. Indexed universal life IUL insurance policies provide greater upside potential flexibility and tax-free gains.

One is that IUL policies can be somewhat complex. There are a number of either straight-up myths or overblown half-truths about how an Indexed Universal Life insurance policy works and grows cash value. Indexed universal life insurance is becoming notorious for being exaggerated and even misrepresented by insurance agents.

Some companies may even set maximum participation rates to be lower than 100 to reduce the returns that can be earned. Some may have participation rates that are as low as 25. On a monthly or annual basis the cash value is credited based on increases in.

In contrast index universal life does follow the stock market as it is indexed to specific sector indices such as the SP 500 or NASDAQ 100. The prevailing tone in many articles criticizing IUL is. That Indexed Universal Life insurance for retirement is not good That IULs crediting strategies are inherently bad for policyholders.

The disadvantages of indexed universal life insurance abound. Here are some more Fees Are Very High. There are fees for.

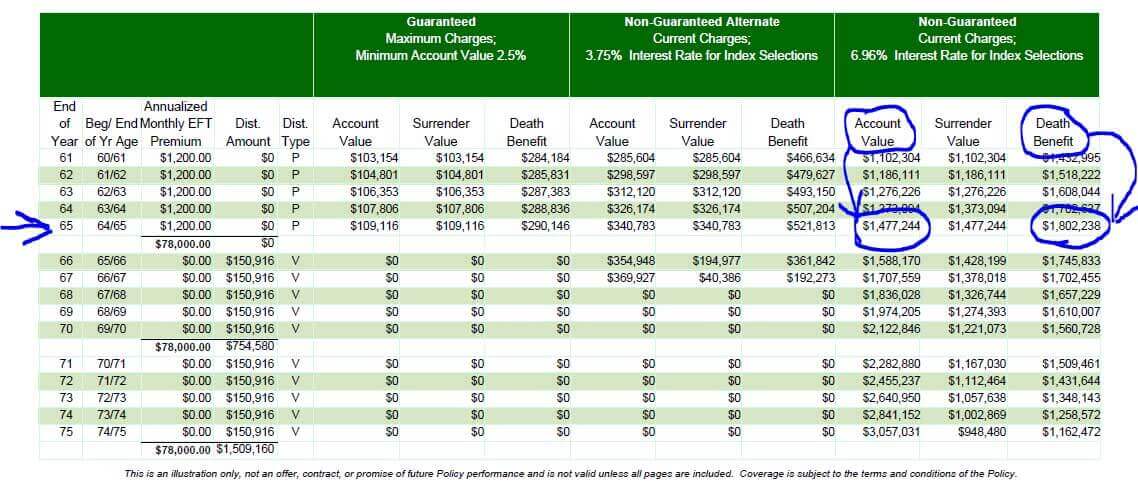

Just look at the above. What Are Your Risks Associated with Owning Indexed Universal Life Insurance. Insurance companies sometimes set a maximum participation rate that is less than 100.

Some of the disadvantages of Indexed Universal Life insurance are that dividends do not count increased policy charges possible earnings cap and mortality charges. Disadvantages of Indexed Universal Life IUL Insurance. Cash value can be further eroded to.

Potential Disadvantages of IUL. And like other forms of. Guarantees vs No Guarantees.

There are some disadvantages of universal life insurance and risks that come from owning an IUL policy. For instance if you have a disposable income of less than 50 after catering for necessities and you need coverage we recommend that you go for level term life insurance. The primary disadvantage of an indexed universal life insurance policy is that most require caps to be placed on the returns that are experienced.

Like all life insurance products it guarantees payment after death. IUL is a hybrid vehicle also known as Stock Indexed Universal Life Insurance. These policies add some of the policyholders premium payments to the annual renewable term insurance and the remainder is added to the monetary value of the policy after the rates have been deducted.

But many indexed or IUL policies CAN lose cash value in spite of sales rhetoric to the contrary. Caps on accumulation percentages. Indexed universal life insurance and universal life insurance for that matter has a lot of fees.

Whole life insurance is a non correlated asset which means that it is does not follow the movement of the stock market. Typically price is a major disadvantage of indexed universal life in comparison to term life insurance. If you are looking for growth stability tax breaks and protection during retirement keep reading.

Indexed Universal Life Insurance Pros And Cons Iul Top 15 Advantages And Disadvantages

Indexed Universal Life Insurance Pros And Cons Iul Top 15 Advantages And Disadvantages

Learn Index Universal Life Pros And Cons Life Insurance Tips And Info

5 Disadvantages Of Indexed Universal Life Insurance Know Your Options

Understanding Life Insurance What Policy Type Is Best For You

The Pros Cons Of Guaranteed Universal Life

Top 10 Best Indexed Universal Life Iul Insurance Companies

5 Disadvantages Of Indexed Universal Life Insurance Know Your Options

The Disadvantages Of Universal Life Regulators Issue A Warning

Iul Policies All You Need To Know About A Tax Free Retirement Ogletree Financial

Top 10 Pros And Cons Of Variable Universal Life Insurance

Indexed Universal Life Insurance Pros And Cons Iul Top 15 Advantages And Disadvantages

Whole Life Vs Indexed Universal Life Insurance Which Is Best

Indexed Universal Life Insurance Pros And Cons Iul Top 15 Advantages And Disadvantages

All You Need To Know About Universal Life Insurance Pros And Cons

Indexed Universal Life Insurance Pros And Cons Iul Top 15 Advantages And Disadvantages

Independent Agent S Guide To Indexed Universal Life Insurace 2020 2021

Independent Agent S Guide To Indexed Universal Life Insurace 2020 2021

Post a Comment for "Disadvantages Of Indexed Universal Life Insurance"