Contingent Beneficiary Of Life Insurance Policies

In the event that the primary beneficiary is unable to receive your proceeds then the contingent beneficiary will be the next in line. They will receive any proceeds from the policy at the time of your death.

Designation Of Beneficiary Under Ibm Group Life Travel Pages 1 2 Flip Pdf Download Fliphtml5

Appointing a contingent owner is therefore a way to sidestep certain problem situations.

Contingent beneficiary of life insurance policies. A beneficiary on your life insurance policy is a person who receives the benefits. Contingent Beneficiary Of Life Insurance Policies. Contingent beneficiaries are second in line to receive the life insurance death benefit.

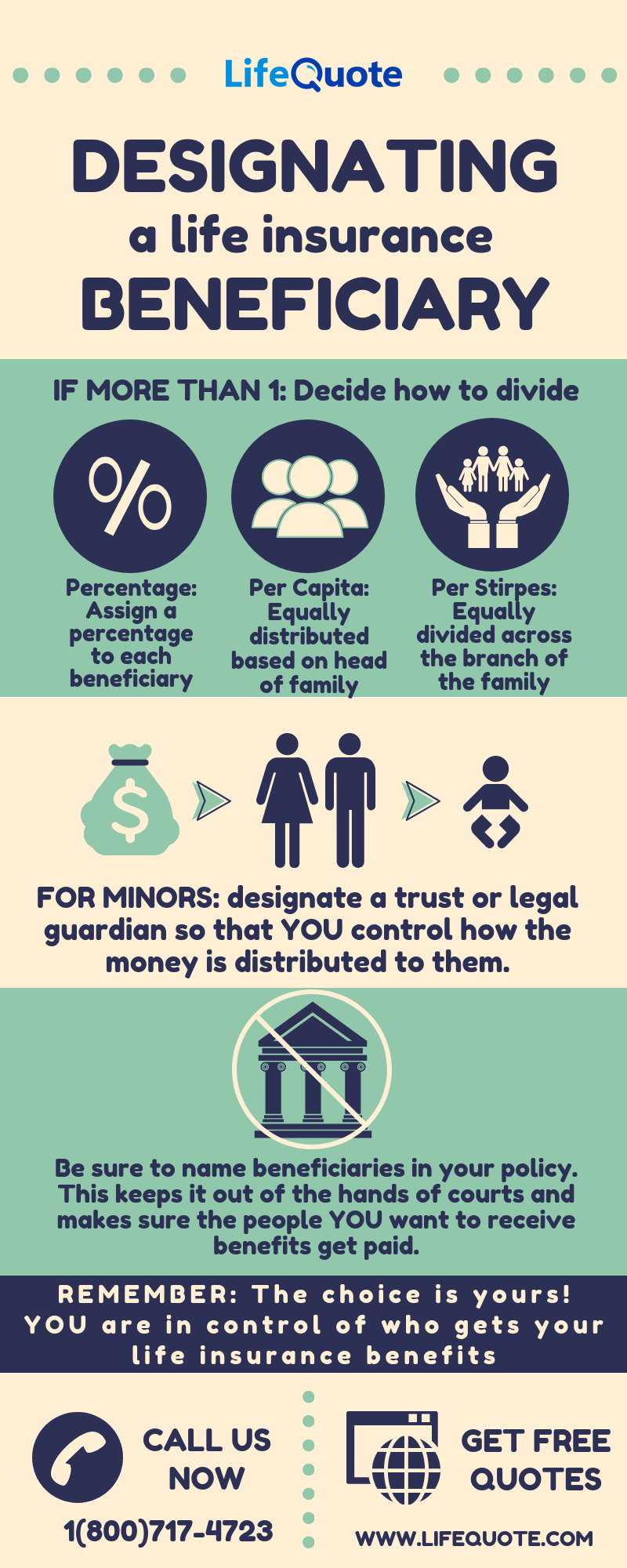

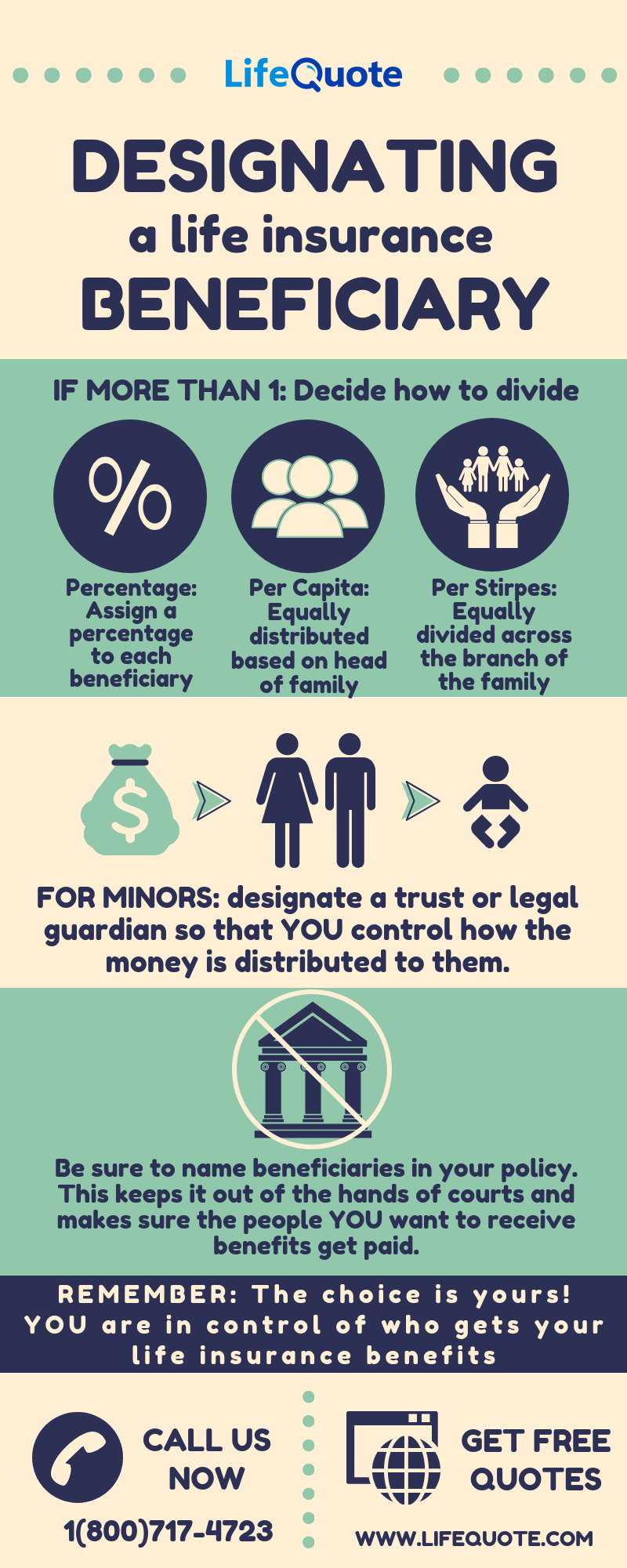

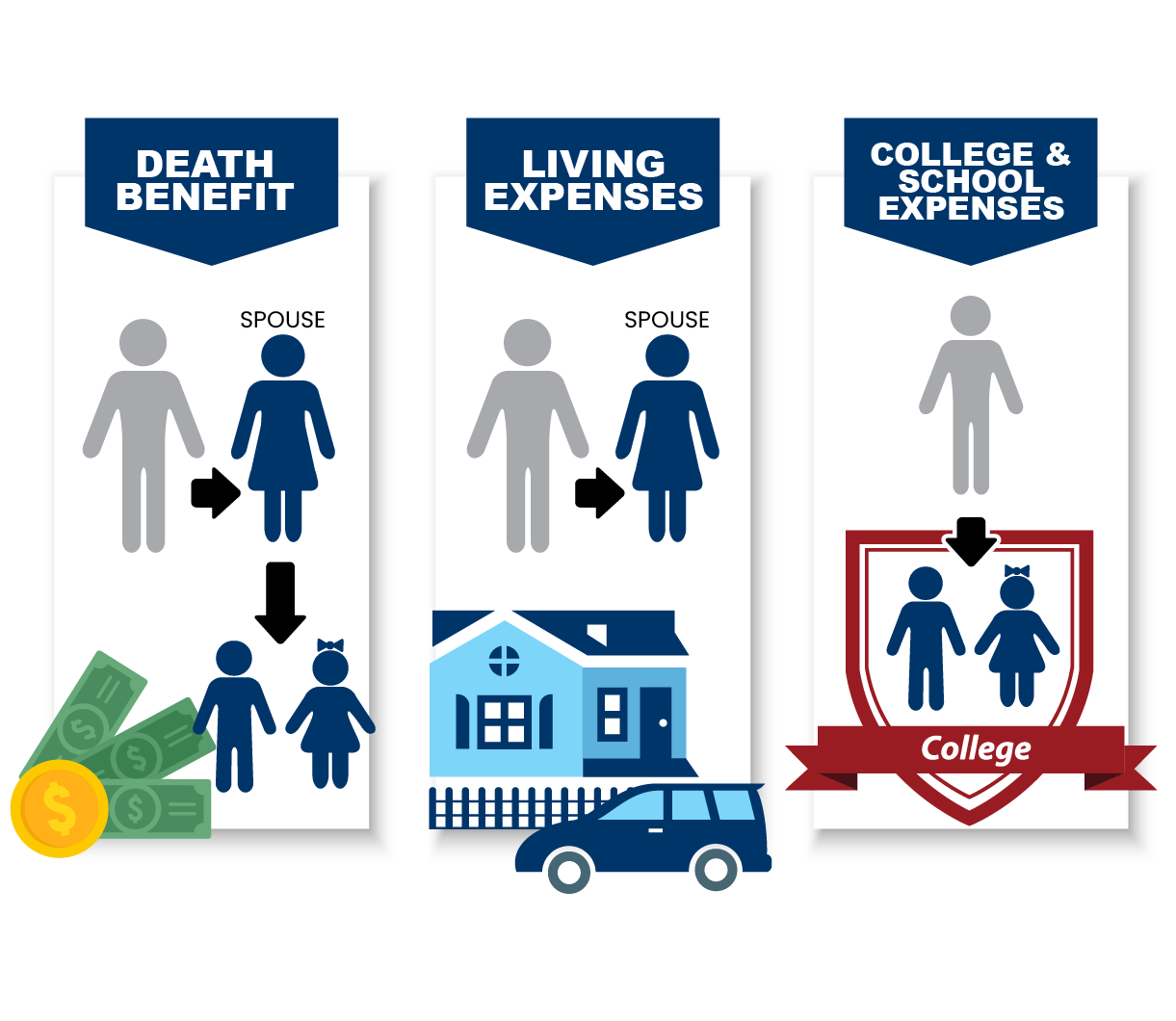

An example of primary and contingent beneficiaries is where a life insurance policyholder names his or her spouse or domestic partner as the primary beneficiary and their children as the contingent beneficiaries. The policy owner can specify the percentage of the will each beneficiary will receive. Contingent ownership of a life insurance policy.

The easiest way to name your contingent beneficiary is when you initially set up your life insurance policy. Primary beneficiaries are first in line and contingent beneficiaries are second in line. Naming a contingent beneficiary on your life insurance policy can save your family added stress during an already emotional and difficult time.

If the beneficiary designation is invalid due to divorce and automatic revocation then a secondary or contingent beneficiary will receive the death benefit and if there are none the benefit will be paid to the insureds estate. The ability to appoint a contingent owner is unique to life insurance and has many advantages. Remember the life insurance contingent beneficiary does not receive any money from the policy unless the primary beneficiary cannot do so.

When a policyholder is buying their life insurance they can name whoever as their beneficiaries spouse children siblings institutions and they can name more than one. Where life insurance is concerned the consequences following the insureds death are often a prime consideration while those following the policy owners death are frequently overlooked. Naming a contingent beneficiary is important as it helps to ensure the benefit bypasses probate.

A contingent beneficiary is a person s organization trust or other entity named by the policyholder to receive their life insurance death benefit if the primary beneficiary is deceased unable to be found legally unqualified to accept it or refuses the benefit at the time the monies are to be paid out. A contingent beneficiary is the person who will receive the death benefit if the primary beneficiary dies before the insured. Contingent beneficiaries can be assigned to life insurance policies retirement plans and annuities.

If you already have a policy and are looking to add or change contingent beneficiaries it can be done. One of the best ways to ensure your assets follow through with your wishes is by designating a contingent beneficiary on a life insurance policy. When you die the primary beneficiary will receive the death.

Also contingent beneficiaries receive your assets in the same manner as primary beneficiaries. This is another kind of contingent beneficiary and only receives assets or proceeds from the estate or insurance company if all the primary and contingent beneficiaries are unqualified to receive the benefits or are deceased. When considering a beneficiary life insurance policies allow you to select a person or entity such as a spouse child or charity.

When purchasing life insurance youll be asked to designate at least one primary. What is a contingent beneficiary. A contingent beneficiary or secondary beneficiary serves as a backup to the primary beneficiaries named on your life insurance policy.

What if there is no contingent beneficiary on a policy. In some states an ex-spouses beneficiary designation is automatically revoked upon divorce. You can designate more than one but it isnt always a simple decision since you need to take into account who will need financial support if you die.

As long as you have a primary beneficiary listed and that person can be found not having a contingent beneficiary will not impact your policy. Another great benefit of this life insurance feature is that there is an option of listing multiple beneficiaries as contingent beneficiaries. In policies from some of the best term life insurance companies a person can assign a primary beneficiary a contingent beneficiary and a tertiary beneficiary.

In this scenario the spouse is provided for if the policyholder dies. Each beneficiary is designated a specific percentage of the money adding up to 100. Difference between Primary and Contingent Beneficiary This is common logic really.

Typically the spouse or partner is assigned as the primary beneficiary of your policy. Your life insurance estate benefit will be received by a contingent beneficiary in case your primary beneficiaries have also passed. It also follows through on.

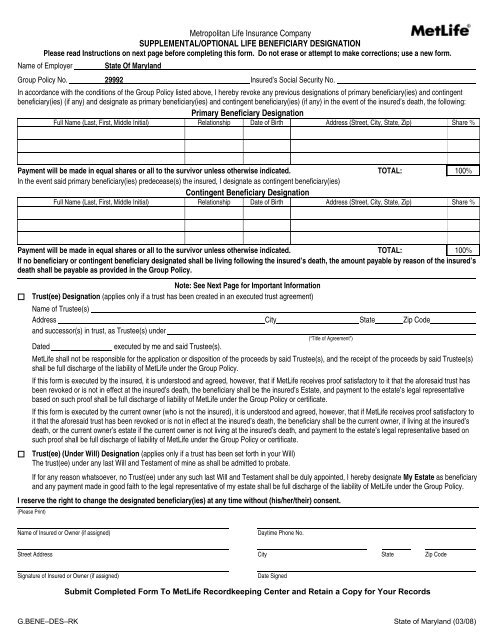

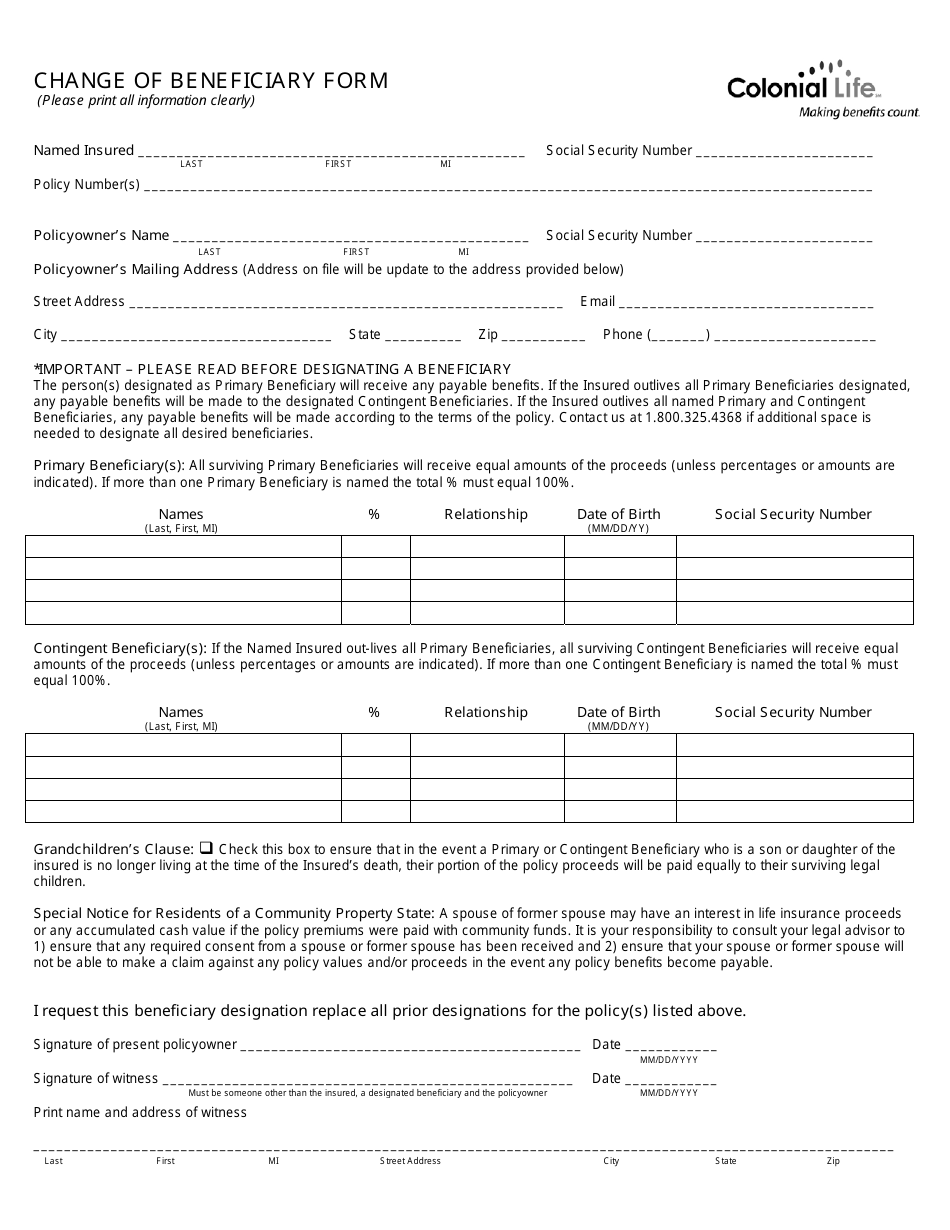

When you pass away if all of your primary beneficiaries have also passed away your contingent beneficiaries will receive the payout. Following is a brief overview of the rules around contingent ownership. When you go through the process there will be a beneficiary designation form.

Within this form are locations for primary and contingent beneficiaries. The children are also financially protected if both the parents pass away. Multiple contingent beneficiaries may be listed on a life insurance policy or retirement account.

Met Life Life Insurance Beneficiary Form Pdf

What Does Contingent Beneficiary Mean

Https Www Markham Ca Wps Wcm Connect Markham C7145560 04b4 4fb4 910e Cc1b3c7fe6b4 Beneficiary Designation Form Pdf Mod Ajperes Convert To Url Cacheid Rootworkspace Z18 2qd4h901ogv160qc8blcrj1001 C7145560 04b4 4fb4 910e Cc1b3c7fe6b4 Msyq Rx

Life Insurance Beneficiary Designation Make A Smart Decision

Life Insurance Policy Basics Life Insurance Policy Basics

Frequently Asked Questions About Contingent Beneficiaries Haffner Law

Aaa Life Insurance Beneficiary Designation Form Life Insurance Blog

Optional Life Insurance For Your Dependent Children

Life Insurance Policy Basics Life Insurance Policy Basics

Understanding Your Life Insurance Policy Policygenius

Who Is Contingent Beneficiary Definition And Insurance Tips

Https Www Standard Com Eforms 17041 643197 Pdf

Designation Of Beneficiary Life Insurance

Designation Of Beneficiary Under Ibm Group Life Travel Pages 1 2 Flip Pdf Download Fliphtml5

Life Insurance Policy Basics Life Insurance Policy Basics

Form 17075 16 Download Fillable Pdf Or Fill Online Change Of Beneficiary Form Colonial Life South Carolina Templateroller

Life Insurance Policy Basics Life Insurance Policy Basics

Post a Comment for "Contingent Beneficiary Of Life Insurance Policies"